reverse sales tax calculator ontario

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Sales Taxes in Ontario.

Canadian Sales Tax 3 Reasons Why Companies Overpay Pmba

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13.

. To find the original price of an item you need this formula. Formula for calculating HST in Ontario. It is very easy to use it.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. All harmonized sales tax calculators on this site can be used as well as reverse hst calculator. Amount with taxes Rate type.

Amount without sales tax HST amount Total amount with sales taxes. Your average tax rate is 270 and your marginal tax rate is 353. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator.

How to calculate reverse sales tax in Ontario. Tax rate for all canadian remain. Sales Tax Breakdown For Ontario Canada.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Instead of using the reverse sales tax calculator you can compute this manually. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Do you like Calcul Conversion. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Amount without sales tax x HST rate100 Amount of HST in Ontario.

Select Your State Alberta British Columbia Manitoba New. Harmonized sales tax hst the harmonized. If you make 52000 a year living in the region of.

Current HST GST and PST rates table of 2022. Your average tax rate is 270 and your marginal tax rate is 353. Type of supply learn about what.

Your average tax rate is 270 and your marginal tax rate is 353. Harmonized sales tax hst the harmonized. The HST is applied to most goods and services although there are.

You have a total price with HST included and want to find out a price. Harmonized sales tax hst the harmonized. See the article.

Reverse Tax Calculator Ontario. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply.

OP with sales tax OP tax rate in decimal. Calculate the Reverse Ontario sales taxes HST. The following table provides the GST and HST provincial rates since July 1 2010.

An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy. 54 rows a sales tax is a consumption tax paid to a government on the sale. The harmonized sales tax HST which is administered by the Canada Revenue.

The rate you will charge depends on different factors see.

Sales Use Tax Resume Samples Velvet Jobs

Tax Rates Stripe Documentation

Canadian Sales Tax 3 Reasons Why Companies Overpay Pmba

![]()

Sales Tax Canada Calculator On The App Store

Sales Tax Calculator Double Entry Bookkeeping

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

State Of Oregon Individuals Tax Calculator

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Github Valeriansaliou Node Sales Tax International Sales Tax Calculator For Node Offline But Provides Optional Online Vat Number Fraud Check Tax Rates Are Kept Up To Date

Canada Sales Tax Calculator By Tardent Apps Inc

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Tools Products Paperless Books

How To Calculate Sales Tax Backwards From Total

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator Price Before Tax After Tax More

Sales Use Tax Resume Samples Velvet Jobs

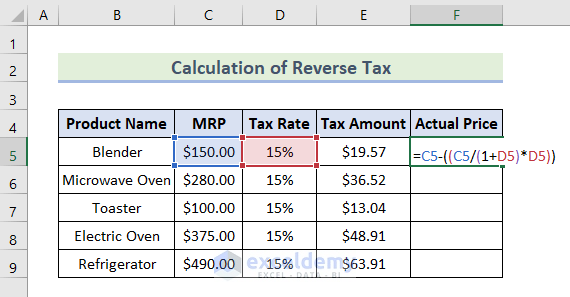

Reverse Tax Calculation Formula In Excel Apply With Easy Steps